Child Tax Credit 2025 Qualifications Schedule – Here’s how much the child tax credit is for 2025, and why you might want to wait to file your tax return this year. . Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child Tax Credit by October 2025 with a tax extension. A claimant must also fill out Schedule 8812 .

Child Tax Credit 2025 Qualifications Schedule

Source : www.investopedia.com

Every EV Qualified for U.S. Tax Credits in 2025

Source : www.visualcapitalist.com

IHCDA: Rental Housing Tax Credits (RHTC)

Source : www.in.gov

Child Tax Credit 2023 2025: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

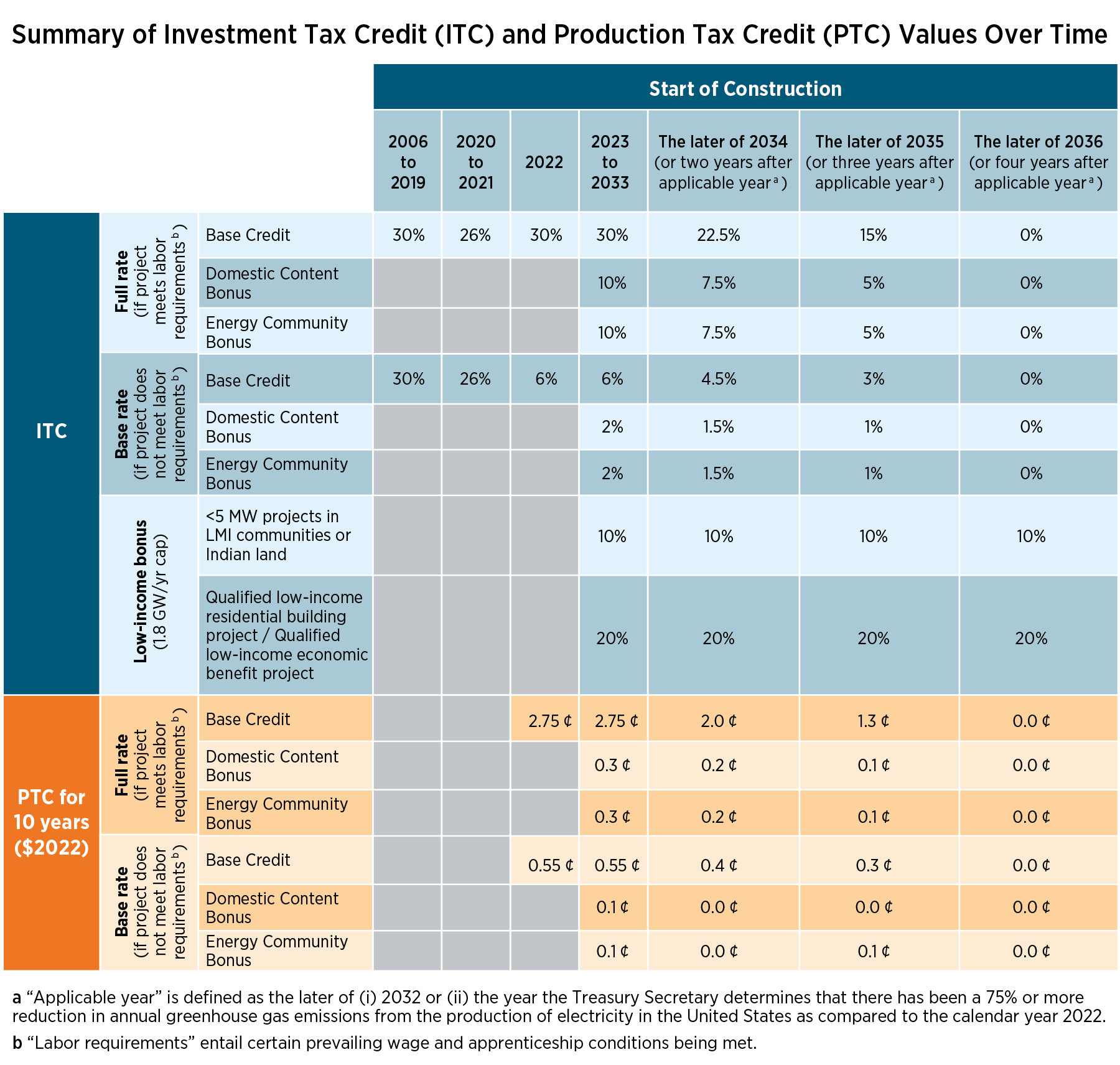

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Child Tax Credit 2023 2025: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Every EV Qualified for U.S. Tax Credits in 2025

Source : www.visualcapitalist.com

Early Learning Parents’ Pages for January 2025

Source : 4cflorida.org

Free Tax Preparation West Central Minnesota Communities Action, Inc.

Source : wcmca.org

2023 and 2025 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit 2025 Qualifications Schedule Child Tax Credit Definition: How It Works and How to Claim It: For the 2025 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 . The child tax credit and other family tax credits and deductions can have a significant impact on your tax liability and potential refund. However, the qualifications for the 2025 tax year .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)